What we offer

In collaboration with Gallagher, we have built five actively managed risk-rated portfolios. The equity building blocks of which have been designed by combining our preferred funds with the aim of optimising style and regional exposure.

By entering into a ground-breaking partnership with Gallagher Investment Consultancy, we are able to offer an innovative range of unbiased globally diversified actively allocated active investment solutions.

In collaboration with Gallagher, we have built five actively managed risk-rated portfolios. The equity building blocks of which have been designed by combining our preferred funds with the aim of optimising style and regional exposure.

Whilst there is no single measure to analyse risk, we are able to view it through multiple lenses by combining Gallagher’s proprietary in-house modelling with external data suppliers and the knowledge and experience of our Investment Committee.

Within our five active portfolios the asset allocation is outcome focussed, centred around delivering the principal investment objectives – this is underpinned by sophisticated risk/return modelling of 150 asset classes and sub strategies.

To deliver our five active portfolios our Investment Committee has had to establish a dynamic working process with Gallagher whereby asset class assumptions are collectively agreed and our Investment Committee reviews the output from the underlying research and modelling processes before any trades are placed.

By implementing this robust approach, we can provide investors with the peace of mind that comes with industry experts working together with a sole focus on positive investor outcomes.

The process begins with Gallagher utilising the leading institutional investment database eVestment to carry out an initial screening process, from which our preferred fund list will ultimately be derived (Stage 1) – all managers who pass the initial screening process are then sent a questionnaire to complete.

Potential fund managers are then selected based on their responses and an ability to demonstrate a competitive advantage in each of ten key categories (Stage 2). This shortlist of managers is then evaluated by Gallagher and finally by our Investment Committee before our list of preferred funds is agreed.

On an ongoing basis, Gallagher monitor our preferred funds via their Red Radar system and will highlight any key risks. If a manager or fund triggers any early warning signals, our Investment Committee is notified, and a review is undertaken – if deemed necessary the fund will be removed and replaced.

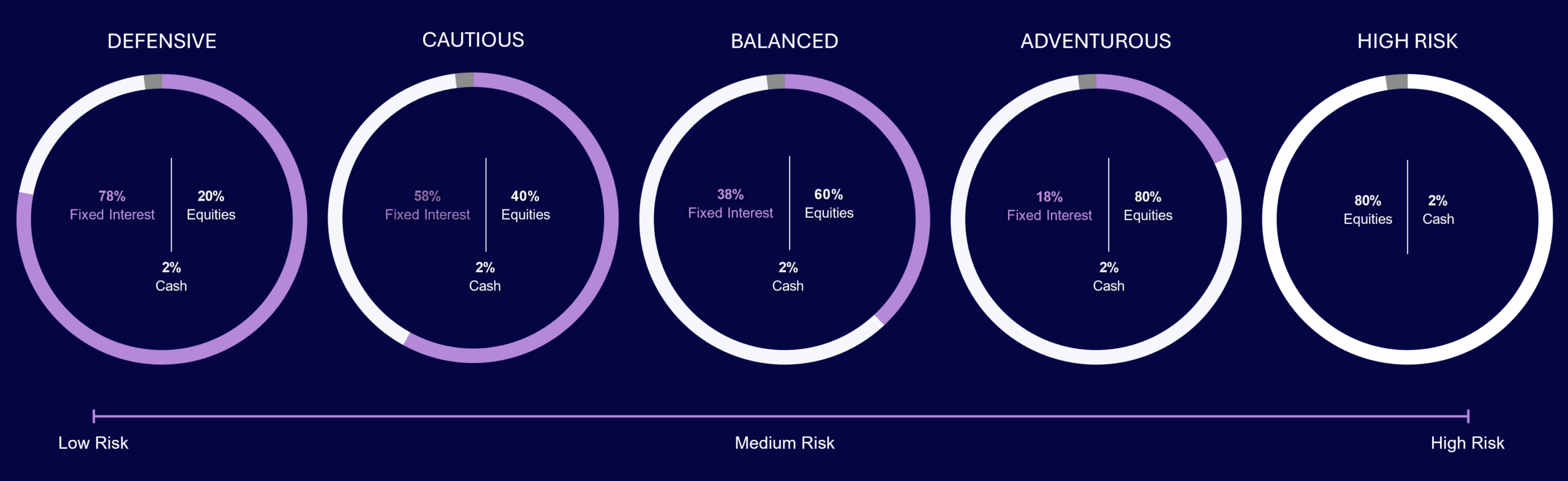

Five model portfolio options are available to match an investor’s attitude to risk, which can be blended if preferred. The portfolios are highly diversified and spread risk by investing across different regions and asset classes.